One of the many benefits of investing in solar energy is the overall tax benefits. These tax credits for solar energy systems allow both home and business owners to reduce the total cost of the installation. Overall there are two different types of tax credits that one would receive, and that is from the Federal and then the State government. For this article, we will be focusing on the Federal Solar Tax Credit or the investment tax credit (ITC) for solar electric systems and how it benefits Long Island homeowners.

What is the Federal Solar Tax Credit?

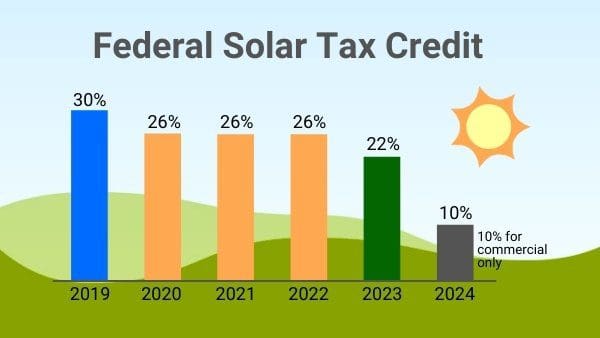

The Federal Solar tax credit or more commonly called the investment tax credit (ITC), allows an individual to deduct 26% of the cost of installing a solar electric system from your federal taxes. The ITC is applicable for both residential and commercial solar electric systems. However, for your system to be redeemable for the ITC, it must be an owned system so therefore not owned by a third-party leasing company. If you are not quite ready to go solar and still would like to think about it, it might end up costing you. The ITC in years passed allowed a home or business owner to recoup 30% of installation costs. However, in 2020 that decreased to 26%, the first time since the ITC’s enactment in 2006! The ITC will continue to be at a 26% tax credit until it steps down to 22% in 2023, and then beginning in the year 2024, residential installations can no longer recoup any federal tax credits. Here is the breakdown of the decrease in tax credits and what effect it will have on your savings:

| System Cost | 30% (2006-2019) | 26% (2020-2022) | 22% (2023) | 10% (2024-Beyond) | |

| Residential | $25,000 | $7,500 | $6,500 (-$1,000) | $5,500 (-$1,000) | $0 (-$5,500) |

| Commercial | $100,000 | $30,00 | $26,000 (-$4,000) | $22,000 (-$4,000) | $10,000 (-$12,000) |

History of ITC

Since the ITC was enacted in 2006 by the passage of the Energy Policy Act, solar installations have grown tremendously. For the last decade, the solar energy sector in the U.S. has increased by more than 10,000%, which breaks down to annual average growth of 52% year over year. The ITC has helped create hundreds of thousands of jobs but as well as allowed for the cost of installations now to become much more affordable. Initially, the Energy Policy Act was set to expire at the end of 2007. However, due to the popularity and it being a crucial engine for renewable energy economic growth, it has been extended quite a few times to now being extended for residential installations to the end of the year 2023.

How Long is the ITC in Effect?

However, even though the ITC was extended multiple times, unfortunately, it is now slated to come to an end. Now the ITC is only available to homeowners in some form through the end of the year 2024. From 2016 to 2019, home and business owners received a 30% tax credit for a solar electric installation. From 2020 until 2022, owners of new residential and commercial solar electric systems received a 26% tax credit. Starting in 2023, the federal tax credit will step down to 22%. In the year 2024 and onwards, only new commercial solar electric installations will receive a 10% federal tax credit. There will no longer be a federal tax credit for a residential solar electric system.

How Does the ITC Work?

A tax credit essentially is a dollar-for-dollar reduction in the income taxes that a person or a company would otherwise pay the federal government. As of May 2021, the solar investment tax credit (ITC) 26% of the total cost of the solar electric system. So, for example, as previously mentioned, an installation that costs $25,000 with the ITC, there would be a tax deduction of $6,500 ($25,000 x 0.26). Costs will vary depending on the installation, but the good news is that the entirety of the installation can be a deduction for your federal tax credit. Some of these items do include:

- All Solar Equipment (Panels, Screws, Bolts, Hardware, etc.)

- Professional Installer Fees

- Engineer fees

- Electrician Fees

- Permitting Fees

Once the installation is complete, we recommend that you gather all of the receipts from expenses to be given to your tax specialist. To prove that you have spent the money on your solar electric installation, your accountant needs to complete an IRS Form 5695, which is for residential energy tax credits.

Don’t miss out on these great benefits! You might have missed out on the 30% federal tax credit, but that does not mean you have to miss out on receiving the full 26% tax credit. Call 631-422-3500 today to receive more information!

References

Residential and Commercial ITC Factsheets. (n.d.). Retrieved May 28, 2020, from https://www.energy.gov/eere/solar/downloads/residential-and-commercial-itc-factsheets

Solar Investment Tax Credit (ITC). (n.d.). Retrieved May 28, 2020, from https://www.seia.org/initiatives/solar-investment-tax-credit-itc