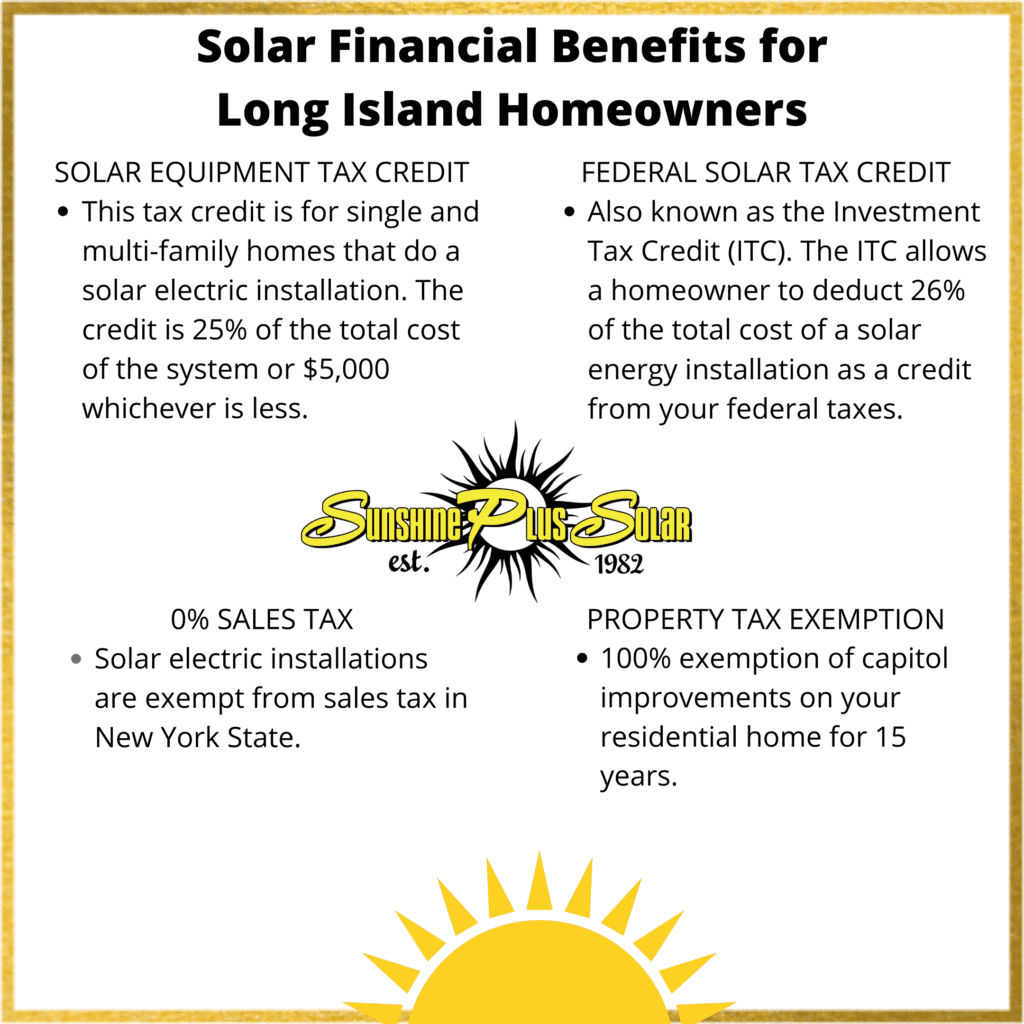

In the United States, New York is one of the handful of states emerging as a leader in the solar energy industry. The municipalities within New York have been very generous with numerous programs to incentivize residents to install solar electric panels in their residences. New York’s Solar Equipment Tax Credit is one of these main incentives. A homeowner with a solar electric installation can receive up to a 25% tax credit with this tax credit. In addition to the equipment tax credit, New York State residents are rewarded by going solar with a 0% sales tax on the installation and a property tax exemption for fifteen years. Last but certainly not least, the Federal solar tax credit adds to the financial benefits with a 26% tax deduction credit off their federal taxes.

What is the New York State Solar Equipment Tax Credit?

The New York State Senate enacted the New York State Solar Equipment Tax Credit on August 2nd of, 2005. The solar equipment tax credit is equal to 25% of the total cost of the solar installation or $5,000, whichever is lower. The NYS solar tax credit is available for residential homeowners with solar electric or solar hot water installation. As a New York State resident, you must complete the appropriate forms to submit to file for the tax credit and your everyday yearly tax documents. As always, we encourage you to consult your accountant or a tax advisor with any questions or assistance filling out the papers.

0% Sales Tax & Property Tax Exemption

In addition to the New York State Solar Equipment Tax Credit, there are a few other ways our customers reap the rewards of the switch to solar. One of those is that a solar electric and or solar hot water installation is exempt from the New York State sales tax. The sales tax currently in New York State is 4%, thus being if your solar electric system is costing you $25,000, you are saving $1,000 outright from not paying sales tax (Formula: $25,000x.04). In addition to the sales tax exemption, New York State has an additional exemption which is a property tax exemption for capital improvements. To explain this further, once you install a solar electric system on your home, the homeowner is now exempt from their property taxes raising from future capital improvements. These capital improvements include things such as an exterior in-ground pool.

Federal Solar Tax Credit

The Federal Solar Tax Credit, or the Investment Tax Credit (ITC), was enacted in 2006 by the passage of the Energy Policy Act. Currently, the ITC allows individuals to deduct 26% of the cost of installing a solar electric system from their federal taxes. However, there will be a step down in the deduction amount of the federal tax credit from 22% in 2021. Then starting in 2022, residential solar electric installations can no longer recoup any federal tax credits.

For a Long Island homeowner to install solar panels for their home is not only a smart idea ethically for the planet but financially. In 2020 a homeowner can recoup 51% of the total cost of their solar electric system through federal and State tax credits.

Are you interested in how tax rebates affect the total cost of your solar panel installation? Give 631-422-3500 a call today to speak with one of our team members!

References

1. Solar Investment Tax Credit (ITC). (n.d.). Retrieved August 10, 2020, from https://www.seia.org/initiatives/solar-investment-tax-credit-itc

2. NY-Sun(Solar Initiative). (n.d.). Retrieved August 10, 2020, from https://www.nyserda.ny.gov/All-Programs/Programs/NY-Sun/Solar-for-Your-Home/Paying-for-Solar/Tax-Credit